Health insurance can feel like navigating a maze blindfolded. Terms like “deductibles,” “premiums,” and “out-of-pocket maximum” can sound confusing, but once you break them down, it’s a lot easier to understand. At HealthNet Assurances, we want to help you in understanding health insurance so you can confidently choose a plan that fits your needs.

In this blog, we’ll explain the key terms, use real-life plan examples, and help you feel confident in understanding your health insurance coverage. By the end, you’ll be equipped to make a smart decision that works for your budget and health needs.

Table of Contents

- What Is a Health Insurance Plan?

- Key Terms You Need to Know

- Breaking Down Two Real-Life Plans

- What Does Coverage Include?

- How to Choose the Right Plan

- Next Steps: Explore Your Options

What Is a Health Insurance Plan?

Think of health insurance as a safety net. It protects you from the high costs of medical care by sharing expenses between you and the insurance provider. Instead of paying all costs upfront, you pay a monthly premium and a portion of the healthcare costs as they arise, depending on the plan.

Key Terms You Need to Know

To ensure you’re understanding health insurance and making informed decisions, it’s essential to grasp the following terms.

Premium

This is the monthly amount you pay to keep your health insurance active. For instance, the Ambetter plan featured below has a $0 premium, while the Aetna plan has a premium of $8.16.

Deductible

The deductible is the amount you pay for healthcare services before your insurance starts covering costs. For example, the Ambetter plan has a $7,500 deductible, meaning you must pay this much before most services are covered.

Out-of-Pocket Maximum

This is the most you’ll pay in a year for covered services, including deductibles and copayments. Once you hit this limit, your insurance covers 100% of costs.

Breaking Down Two Real-Life Plans

Let’s use two actual health insurance plans to show how these key terms come into play.

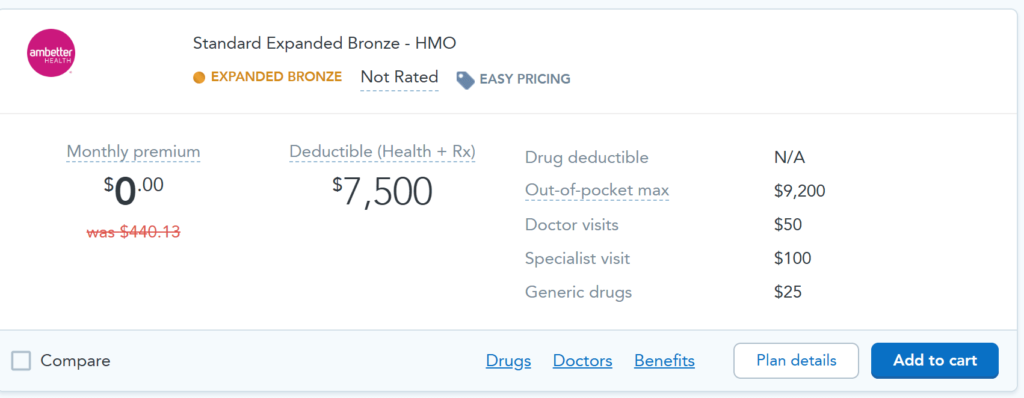

Ambetter Expanded Bronze

- Monthly Premium: $0

- Deductible (Health + Rx): $7,500

- Out-of-Pocket Maximum: $9,200

- Doctor Visits: $50

- Generic Drugs: $25

This plan is ideal for individuals seeking low upfront costs but who are prepared for higher out-of-pocket expenses.

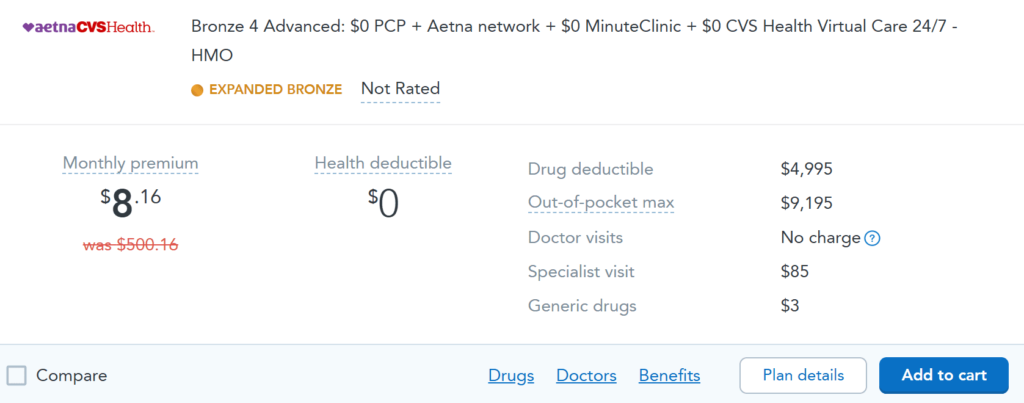

Aetna Bronze 4 Advanced

- Monthly Premium: $8.16

- Health Deductible: $0

- Out-of-Pocket Maximum: $9,195

- Doctor Visits: No Charge

- Generic Drugs: $3

This plan might suit individuals who prefer lower deductibles and slightly higher premiums to manage costs better throughout the year.

What Does Coverage Include?

When it comes to understanding health insurance, knowing what coverage includes is key. Each plan covers a range of essential benefits such as:

- Preventive Care: Annual checkups, screenings, and vaccinations.

- Doctor Visits: General or specialist care.

- Prescription Drugs: Generic and branded medications.

For example, the Aetna plan provides free doctor visits, while the Ambetter plan charges $50 per visit.

How to Choose the Right Plan

Choosing the right plan depends on your health needs and financial situation.

Consider These Factors:

- Frequency of Doctor Visits: If you need regular care, a plan like Aetna’s, with no charge for visits, might be better.

- Budget for Monthly Costs: Opt for a lower premium if you’re comfortable with higher out-of-pocket expenses.

- Prescription Needs: Check drug coverage. Aetna offers $3 generic drugs, while Ambetter charges $25.

Pro Tip: Always compare the out-of-pocket maximum. It can protect you from overwhelming expenses during emergencies.

Next Steps: Explore Your Options

Now that you understand key terms and how coverage works, it’s time to take the next step.